- #Using unusual options activity how to

- #Using unusual options activity update

- #Using unusual options activity series

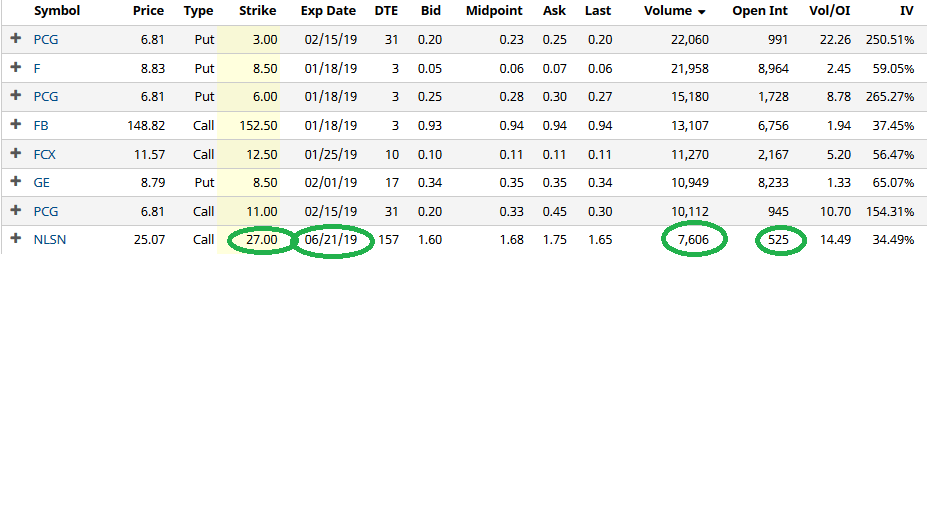

Like you said, UOA plays don't work on Index funds and I found this out the hard way after taking some losses on $SPY and $IWM. I recently got into UOA plays after profiting bigly on $GILD and $SHAK. TL DR: if you're reading this then this post isn't for you. UOA is a difficult strategy to master, but once you know what you're doing it can be a consistent and profitable strategy. These are critical to determine direction of bets.Īnd that's about it. You MUST have a deep understanding of every option strategy.Option orders leave footprints in the form of MM orders.This is the best method to differentiate between hedges and bets, but it is not an exact science and is sometimes very subjective until the trade runs its course.Bid/Ask Spread analysis will help you determine how aggressive orders were and whether or not order flow was buying or selling.Understanding the Dynamics of volume and open interest is a great way to determine whether orders are opening or closing.With that out of the way, here are general things to look out for. That being said, with proper risk management and a well developed set of financial skills, it can be a great supplement to an existing trading strategy. UOA is NOT the holy grail of trading, or else other people would have already jumped in on it.

It by no means is an easy way to make money and it is very difficult to differentiate hedges and bets. It really requires an understanding of different types of option spreads, MM behavior, option pricing, and fundamental analysis.

#Using unusual options activity update

Plus they update super slowly so you'll miss out on trades anyways.Īnalyzing UOA is more of an art than a science. It does not show individual order flow and you have no way to tell if they were selling, buying, opening or closing positions. One thing of note, websites like BarChart are good for a general picture, but never trade based on options activity found on BarChart alone. If you're interested, there are many videos on the art of scanning for UOA.

There are many services that can scan for UOA, but you guys all have google and I'm not going to shill products. Stop burning your cash through trying to predict ETFs IWM is not going to have a shitty press release and tank after earnings. SPY is not going to hostilly takeover Apple. Even Bridgewater Associates, the largest hedge fund in the world headed by Ray Dalio, experienced massive losses during the current COVID-Crash. I don't care how smart an institution is, no institution can predict the market. UOA is NOT useful for ETF's such as SPY, QQQ, or USO. Insider trading is a lot more common than you think, and sometimes you can see institutional order flow to predict big stock moves before they occur. Institutions are smart, richer, and have far more resources than your average retail investor, so piggybacking off of their plays will usually net you a profit 9/10 times. UOA is primarily used to see institutional option order flow in order to piggyback off their plays. Generally volumes above one to two thousand on smaller cap stocks or in the tens of thousands for larger more liquid equities.

#Using unusual options activity series

Unusual options activity occurs when a certain contract on a specific series experiences unusually high volume.

#Using unusual options activity how to

My goal is to give you guys a guideline one where to begin your studies, but I'm not here to teach you guys outright on how to trade Unusual Options Activity. I'll keep this fairly high-level, and I encourage those who are inspired by this post to do more research on the subject. Hey all, I've received a good number of requests to post a guide on how exactly one trades high volume unusual options activity.

0 kommentar(er)

0 kommentar(er)